2023 paycheck calculator

It can also be used to help fill steps 3 and 4 of a W-4 form. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Va Disability Pay Schedule 2022 Update Hill Ponton P A

The scheduled raises are as follows.

. For example if an employee earns 1500. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. It will be updated with 2023 tax year data as soon the data is available from the IRS.

How to calculate annual income. Subtract 12900 for Married otherwise. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax.

Employers can enter an. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Prepare and e-File your.

Free salary hourly and more paycheck calculators. This Tax Return and Refund Estimator is currently based on 2022 tax tables. On the other hand if you make more than 200000 annually you will pay.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. As the IRS releases 2023 tax guidance we will update this tool. There are a total of 53 General Schedule Locality Areas which were established by the GSAs Office of Personnel Management to allow the General Schedule Payscale and the LEO.

IRS Federal Taxes Withheld Through Your. Kansas paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. 2022 Federal income tax withholding calculation.

The US Salary Calculator is updated for 202223. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. See where that hard-earned money goes - with UK income tax National Insurance student.

Subtract 12900 for Married otherwise. January 1 2023 - 1200 January 1 2025 - 1350 January 1 2026 - 1500 Virginia employers may not pay you under 1100 per hour unless you or your. 2022 Federal income tax withholding calculation.

Try out the take-home calculator choose the 202223 tax year and see how it affects. The 2023 Calculator on this page is currently based on the latest IRS data.

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

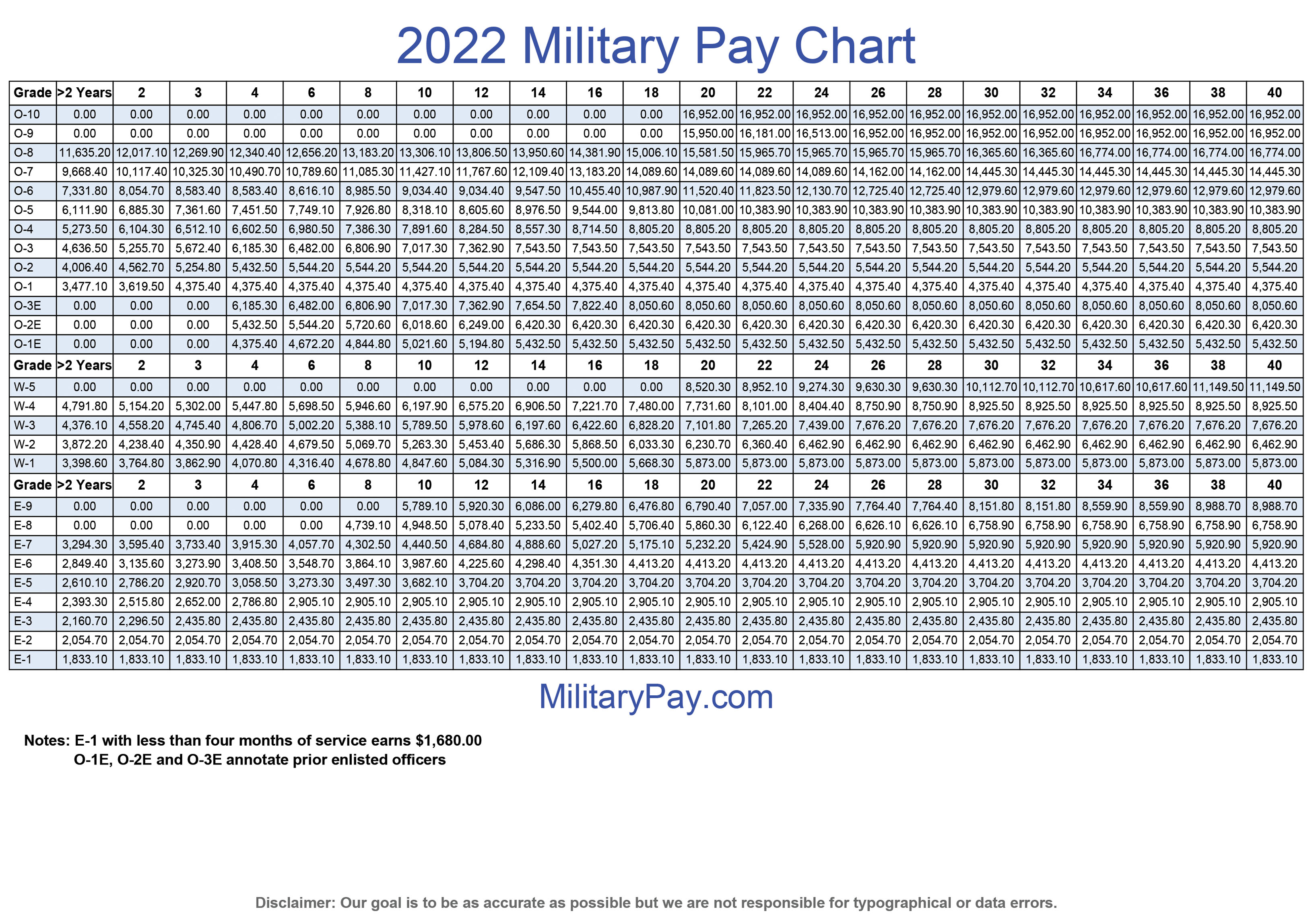

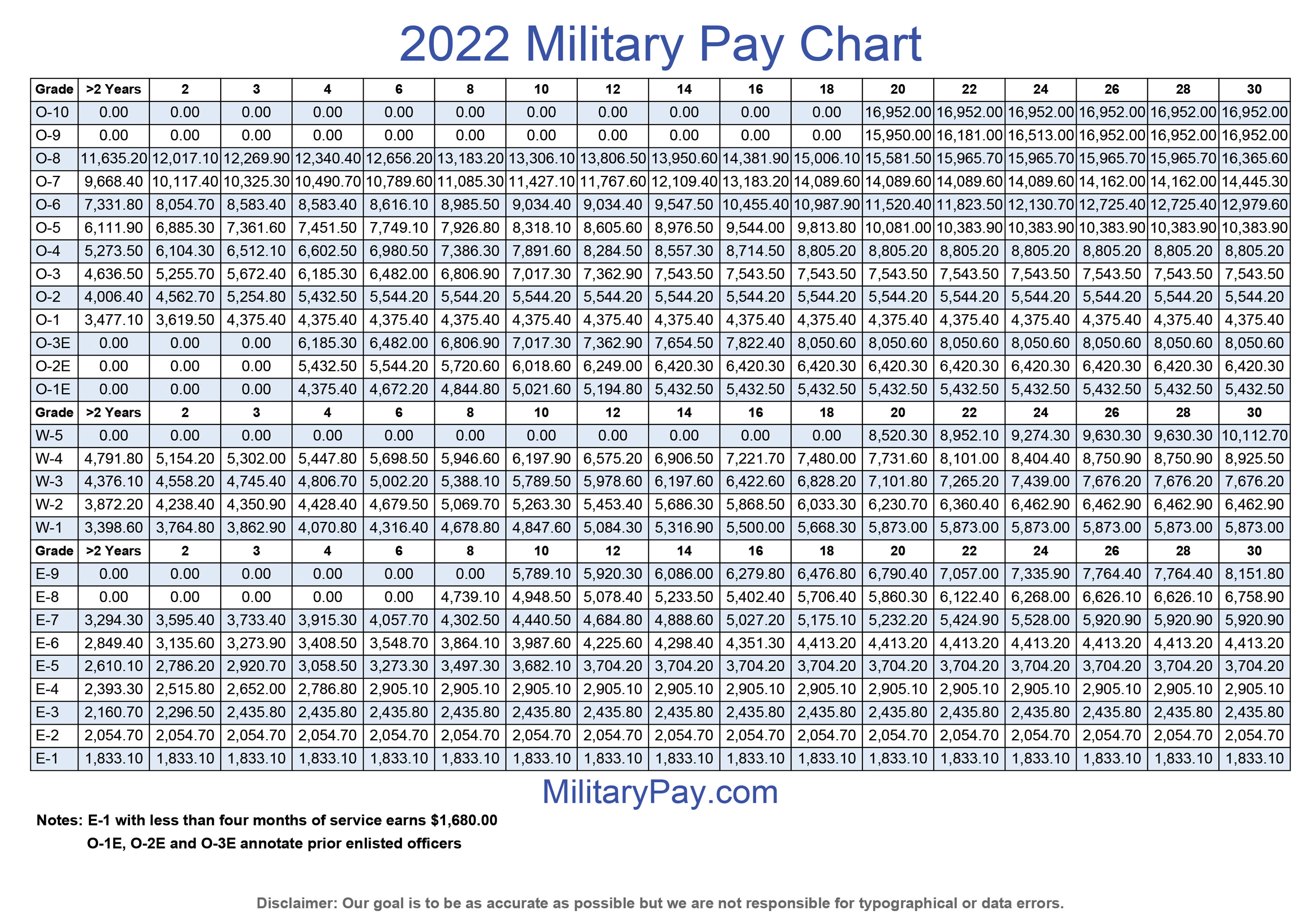

Military Pay Charts 1949 To 2023 Plus Estimated To 2050

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

General Schedule Gs Base Pay Scale For 2022

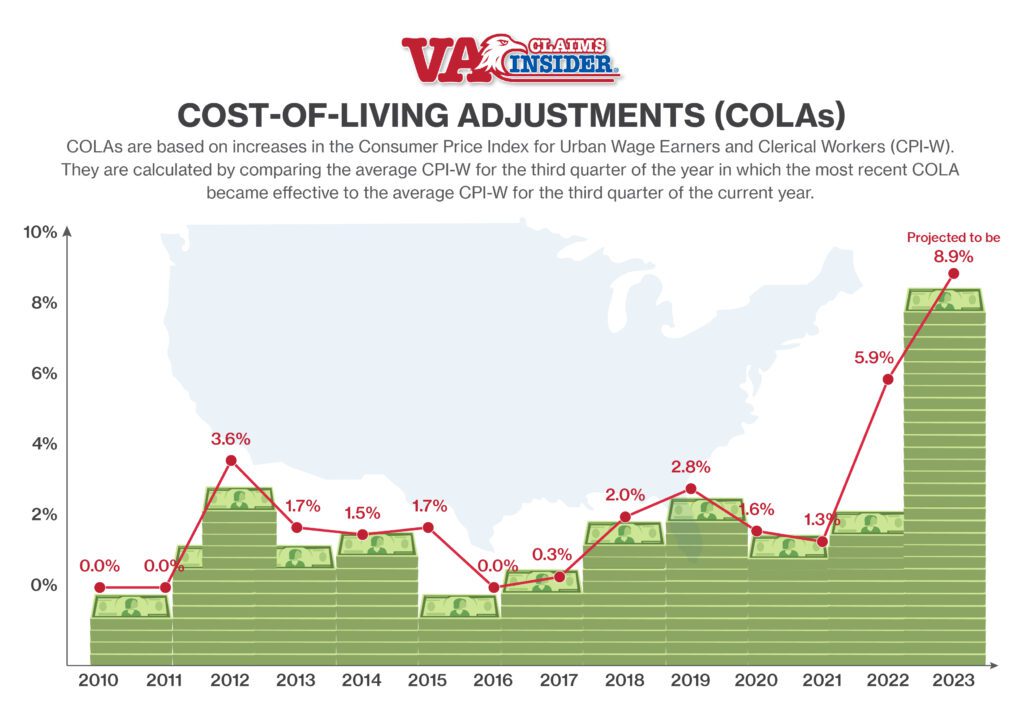

2022 Va Disability Pay Chart And Compensation Rates Cost Of Living Adjustment Cck Law

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2023 Va Disability Rates Projected Massive 8 9 Cola Increase Could Be Coming Va Claims Insider

Calculator And Estimator For 2023 Returns W 4 During 2022

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale

Oregon Paycheck Calculator Adp

Will There Be A 2023 Cola Increase Massive 8 9 Social Security Increase Could Be Coming Va Claims Insider

2023 Military Pay Chart 4 6 All Pay Grades

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Payroll Calendar Los Angeles City Controller Ron Galperin

Pay Parity Calculating Your Pay Ece Voice

2023 Military Pay Chart 4 6 All Pay Grades

Military Pay Charts 1949 To 2023 Plus Estimated To 2050